Credit Spreads: Limited Risk Options Strategy for Consistent Income

Buying options is a "negative expectancy" game for most traders because time decay (Theta) works against you every single day. The moment you buy a Call or Put, the clock starts ticking, eating away your value. What if you could flip the script? What if you could be the "Casino" instead of the gambler? Credit spreads allow you to collect premium upfront while strictly limiting your risk. You don't need the stock to move in your direction to win; you just need it to not move against you. It is the core income strategy for professional options traders who care about consistency over home runs.

Key Takeaways

- Be the Casino: Credit spreads allow you to collect premium (income) upfront. You profit from the passage of time (Theta Decay), not just directional moves.

- Defined Risk: Unlike naked option selling (which has unlimited risk), spreads cap your maximum loss to a specific dollar amount known at entry. You can never lose more than the spread width minus credit received.

- High Probability: Typical credit spreads are structured to have a 70-80% probability of profit. You win small, consistently, which compounds over time.

- Two Flavors: Bull Put Spreads (Neutral-to-Bullish) and Bear Call Spreads (Neutral-to-Bearish). Both benefit from time decay and volatility crush.

- Margin Efficient: Because risk is capped, brokers require far less capital (margin) to hold these trades compared to naked puts, effectively leveraging your returns.

Who This Is For

Advanced LevelPerfect if you:

- You are tired of buying Calls/Puts and watching them expire worthless due to Theta decay

- You want to generate monthly income from your portfolio to supplement returns (The 'Yield Boost')

- You have a directional view but want a 'margin of safety' in case you are slightly wrong

- You want to trade expensive stocks like Amazon or Google with a small account ($2,000 - $5,000)

You'll learn:

- The mechanics of selling a 'Short Leg' and buying a 'Long Leg' protection

- How to select the 'Sweet Spot' strikes (30-Delta) for optimal risk/reward ratios

- The 'Tastytrade' mechanics: when to roll, when to close (50% profit rule), and how to manage early assignment

- The 'Day-by-Day' decay cycle: What a winning trade looks like over 30 days

Part 1: What Is a Credit Spread?

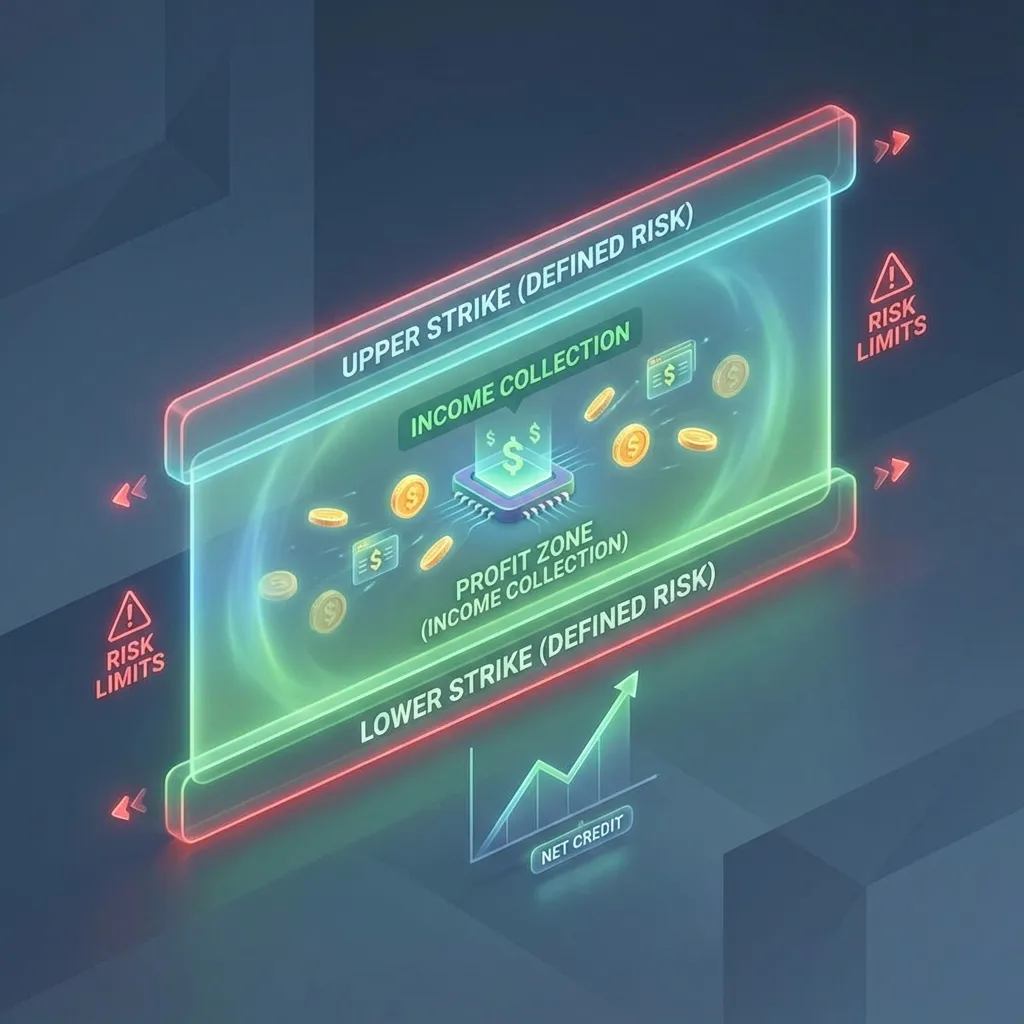

A credit spread (also called a vertical spread) is an options strategy where you sell one option (to collect income) and simultaneously buy another option of the same type (to act as insurance).

Because the money you receive from selling the closer-to-the-money option is higher than the money you pay for the further-out option, you receive a Net Credit into your account immediately.

The Golden Rule: The credit you receive is your MAXIMUM profit. The width of the spread minus the credit is your MAXIMUM risk. You generally cannot lose more than this defined amount.

The "Insurance Industry" Analogy

Think of yourself as an insurance company (e.g., Geico).

- You sell insurance (Put Option) to a nervous driver (Stock Owner).

- They pay you a premium ($100).

- Most of the time (80%), they don't crash. You keep the $100.

- To protect yourself from a total disaster (Hurricane), you buy "Re-insurance" (The Long Put) from a bigger bank for $20.

Result: You keep the difference ($80). You profit from other people's fear. If the hurricane hits, the reinsurance pays out, saving you from bankruptcy. This is the essence of a Credit Spread.

Part 2: Two Types of Credit Spreads

Bull Put Spread (The "Floor")

Outlook: Neutral to Bullish. "I don't think the stock will crash below this floor."

- • Sell Put at Strike A (e.g., $95)

- • Buy Put at Strike B (e.g., $90)

- • Profit Zone: Anywhere ABOVE $95 at expiration.

- • Ideal For: Blue-chip uptrends or sold-off stocks finding support.

Bear Call Spread (The "Ceiling")

Outlook: Neutral to Bearish. "I don't think the stock will rally above this ceiling."

- • Sell Call at Strike A (e.g., $105)

- • Buy Call at Strike B (e.g., $110)

- • Profit Zone: Anywhere BELOW $105 at expiration.

- • Ideal For: Fading overbought tech stocks or downtrends.

Part 3: The Mechanics of Winning (Greeks)

Why do pros love this? Because the Greeks are on your side. You are aligning probability with mathematics.

| Greek | Role | Your Edge |

|---|---|---|

| Theta (Time) | Decay of value per day | Positive. You profit as time passes. Every day the stock does nothing, you make money. Weekends are free money. This is your primary engine of wealth. |

| Vega (Volatility) | Sensitivity to Vol changes | Negative (Short Vega). You want volatility to CRUSH. Best entered when VIX is high and fear is peaking. As fear subsides, option prices drop, and you profit. |

| Delta (Price) | Sensitivity to Price | Directional. You make money if the stock moves your way OR stays flat. You have a "Margin of Error." A Bull Put Spread loses money slowly as the stock drops, giving you time to escape. |

Real Example: SPY Bull Put Spread

Educational ExampleCollecting income on the S&P 500

SPY is trading at $450. You think it will stay above $440 for the next month.

The Setup

- • Sell $440 Put (30 Delta) for $3.50 Credit

- • Buy $435 Put (Protection) for $2.00 Debit

- • Net Credit Received: $1.50 ($150 per contract) - deposited instantly.

- • Max Risk: $350 ($5 width - $1.50 credit) - held as collateral.

- • Return on Capital: 42% ($150 / $350) in 30 days.

Scenario A: Win

SPY closes at $441 (or $500). Both options expire worthless. You keep the full $150 credit. This happens ~70% of the time.

Scenario B: Scratch

SPY closes at $438.50. You lose $1.50 on the stock, offsetting your credit. Breakeven. You neither win nor lose.

Scenario C: Max Loss

SPY crashes to $400. Unlike owning stock (losing $5,000), your loss stops at $350. The Long Put saves you. This happens ~5% of the time.

This is a hypothetical scenario using historical market data for educational purposes only. Past performance does not guarantee future results.

Part 4: The Strike Selection "Sweet Spot"

Where do you place your bets? This is the most crucial decision.

The 30-Delta Rule: Statistical analysis suggests the optimal short strike is around the 30 Delta (approx 70% probability of expiring out of the money).

Selling ATM. Highest Premium, but 50/50 chance of losing. This is basically a coin flip direction bet with capped upside. Gambler's ruin.

1 Standard Deviation Move. Collects healthy premium. Price has to move significantly against you to lose. The best balance of income and sleep.

Selling way OTM. 90% Win Rate, but tiny premium ("Picking up pennies in front of a steamroller"). One loss wipes out 20 wins. Not worth the commission.

Part 5: Implied Volatility (IV) Rank - The Secret Sauce

You should not sell credit spreads on calm, boring stocks (Low IV). Why? Because the premiums are tiny.

You want to sell fear. You want to sell when IV is HIGH.

The Rule: Only trade Credit Spreads when IV Rank is > 30 (preferably > 50).

- Low IV Environment: Options are cheap. You get $0.50 for a $5 spread. Risk/Reward is 1:9. Terrible. You have no buffer if the trade goes wrong.

- High IV Environment: Options are expensive. You get $1.50 for a $5 spread. Risk/Reward is 1:2.3. Amazing. You have a huge buffer.

This creates a "Volatility Edge." If you sell when Volatility is high, you profit from Mean Reversion as Volatility inevitably contracts back to normal.

Part 6: Day-by-Day Walkthrough of a Trade

What does it feel like to hold a credit spread? Let's simulate a 30-day trade.

Stock is $100. You sell the $95/$90 Put Spread for $1.00. You are nervous. "Did I top tick the market?"

Stock is $102. Theta is working. The spread is now worth $0.80. You are up $20 per contract. "Boring is good."

Stock drops to $96. Panic sets in. It's close to your $95 strike. The spread balloons to $1.20 (loss of $20). Do you close? No, you trust the probabilities. You hold.

Stock bounces to $98. IV crushes. The spread collapses to $0.40. You are up $60. You hit your 50% profit target.

You buy back the spread for $0.40. You keep $60 profit. You sleep well.

Part 7: When to Expect The Unexpected (Defense)

What happens when the trade goes against you? Do you just take the loss? No. You adjust. As a spread trader, you are a mechanic.

Defense 1: Roll Out and Down

Close your current spread for a loss, but simultaneously open a new spread for next month at a lower strike. You collect a massive credit for adding time (Theta), which helps offset the realized loss. This is called "Kicking the can down the road" to buy time for a rebound.

Defense 2: Turn it into an Iron Condor

If your Bull Put Spread is losing because the stock is crashing, sell a Bear Call Spread on top of it. You collect more premium, reducing your max risk. You are now betting the stock will stay in a range.

Part 8: Execution & Management (The 50% Rule)

Novice traders hold until expiration to get every penny. Pro traders close early to increase velocity of capital.

If you collected $1.00 credit, and the spread is now trading for $0.50, CLOSE IT. You have captured 50% of max profit in perhaps only 25% of the time. The risk of holding for the last $0.50 isn't worth it (gamma risk). Take the money and run.

Never hold a credit spread through an earnings report. The volatility can blow through your strikes in seconds. This is a "steady income" strategy, not a gambling strategy. Close before the announcement.

Part 9: Common Mistakes (How NOT to Trade)

Even with defined risk, you can lose money if you get sloppy.

- Legging In: Trying to time the entry by selling the short leg first and waiting to buy the long leg later. If the market crashes in between, you are naked short and exposed to infinite risk. Always execute both legs simultaneously as a "Vertical Spread" order.

- Forcing Trades: Trading when IV Rank is low (<20). The premiums are too small to justify the risk. Be patient. Cash is a position.

- Over-Leveraging: Just because you can open 10 contracts doesn't mean you should. One bad gap down could wipe out your account. Stick to risking 2-5% of your portfolio per trade.

Part 10: The "Screener" Criteria (How to find trades)

Don't just stare at the chart. Use a screener to find the math.

LIQUIDITY: Volume > 1M shares/day (Tight Bid-Ask Spreads)

IV RANK: > 30 (Expensive Options)

EXPIRATION: 30-45 Days (Optimal Theta Curve)

DELTA: 0.30 (70% Prob. OTM)

EARNINGS: None in next 30 days

Part 11: Tax Efficiency

One hidden benefit of trading Index Options (like SPX or XSP) vs. Stocks (like SPY) is taxes.

Section 1256 Contracts: Broad-based index options qualify for a 60/40 tax split. 60% of your gains are taxed at the lower "Long Term Capital Gains" rate (even if you held for 1 day), and 40% are Short Term.

For a high-income earner, trading SPX spreads instead of SPY spreads can save thousands in taxes annually.

FAQ: Credit Spreads

What capital do I need?

What is early assignment risk?

Can I do this in an IRA?

Start Small, Think Big

Credit spreads are the bread and butter of professional trading. They turn the market's "random walk" into a solvable probability equation.

Get Level 2/3 Options Approval.

Identify a stock with High IV Rank (>30).

Sell the 30-Delta Spread. Set GTC close at 50%.

About Stock Averager Team

Expert financial analysts dedicated to simplifying complex investment strategies for everyone. We build tools that help you make better money decisions.