Diversification: The Only Free Lunch in Investing

Don't put all eggs in one basket. Diversification reduces risk without sacrificing returns. Learn how to diversify across stocks, sectors, and geographies.

Expert analysis, strategies, and guides to help you make smarter investment decisions

Don't put all eggs in one basket. Diversification reduces risk without sacrificing returns. Learn how to diversify across stocks, sectors, and geographies.

Buying is easy; selling is hard. Learn how to use Dollar Cost Averaging in reverse to take profits or generate retirement income smoothly.

It feels wrong to sell your best performers, but it's essential for risk control. Learn the when, why, and how of portfolio rebalancing.

Different sectors win at different times. Learn how to rotate your portfolio into the right industries based on the business cycle.

Is your portfolio too US-centric? Discover why you need global exposure to reduce risk and capture growth in emerging economies.

Fear Of Missing Out is the #1 portfolio killer. Learn to control your emotions, ignore the hype, and stick to your strategy.

Your brain is hardwired to fail at investing. Learn about loss aversion, confirmation bias, and the psychology that sabotages portfolios.

Don't buy at the top. The RSI indicator warns you when a stock is overheated or oversold, helping you time your entries and exits better.

Cut through the noise. Moving averages help you identify the true trend, spot reversals, and find dynamic support levels used by pros.

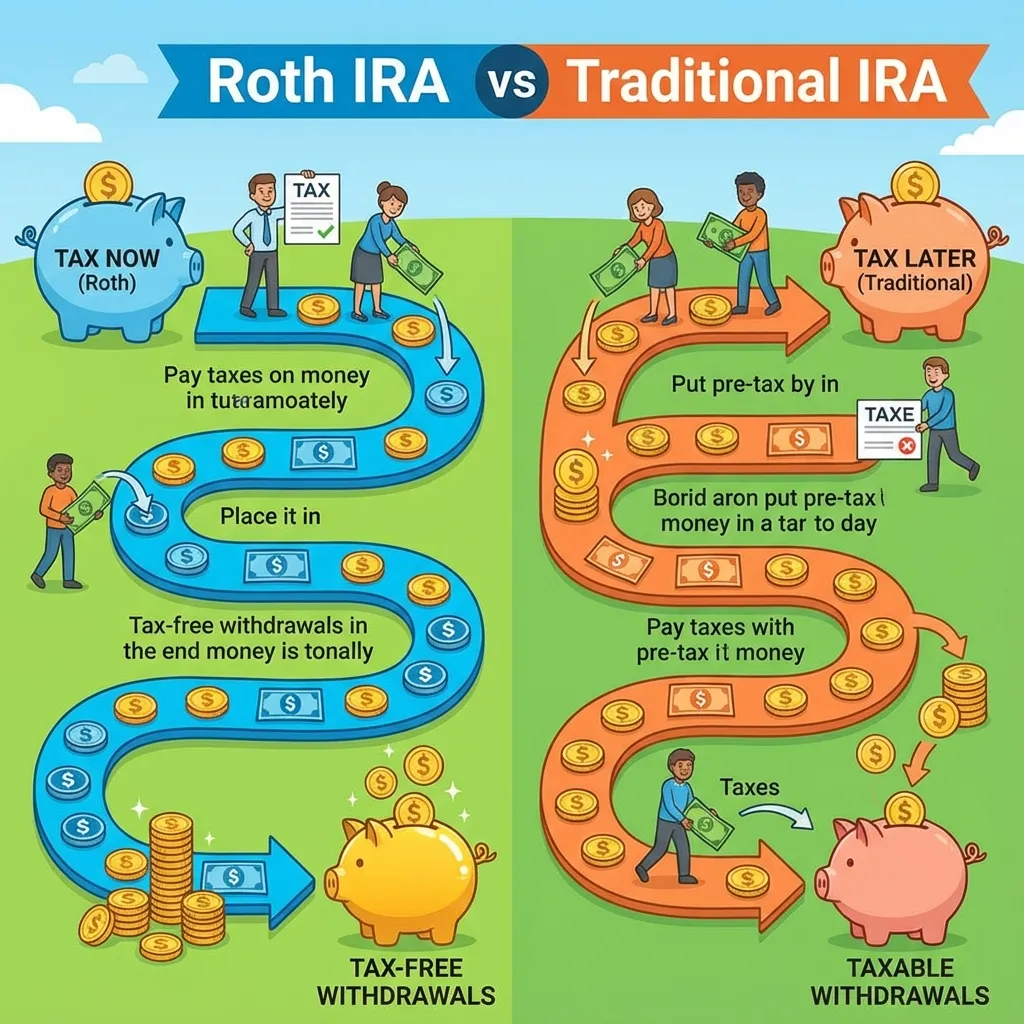

Tax now or tax later? Choosing the right IRA can mean thousands more in retirement. We break down the math to help you decide.

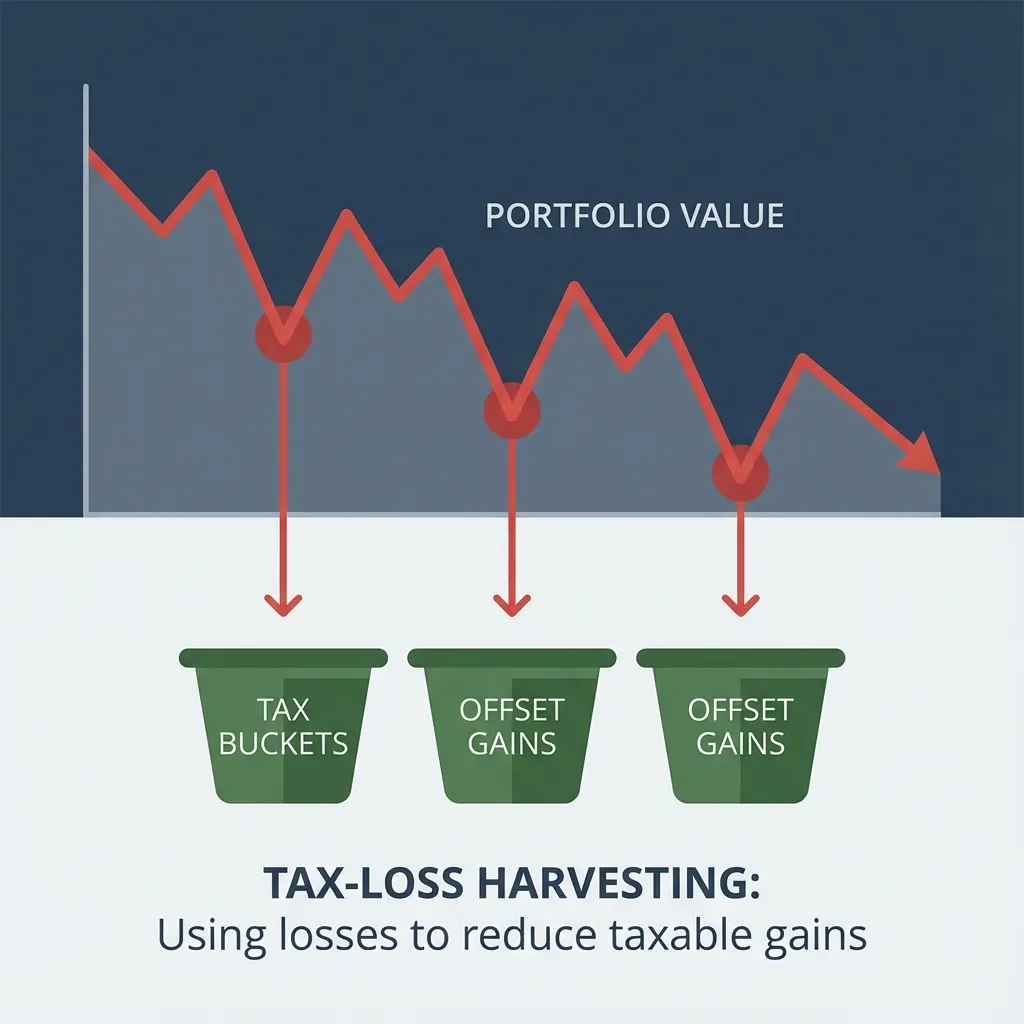

Don't let market drops go to waste. Learn how to harvest losses to offset gains and reduce your tax bill, boosting your after-tax returns.

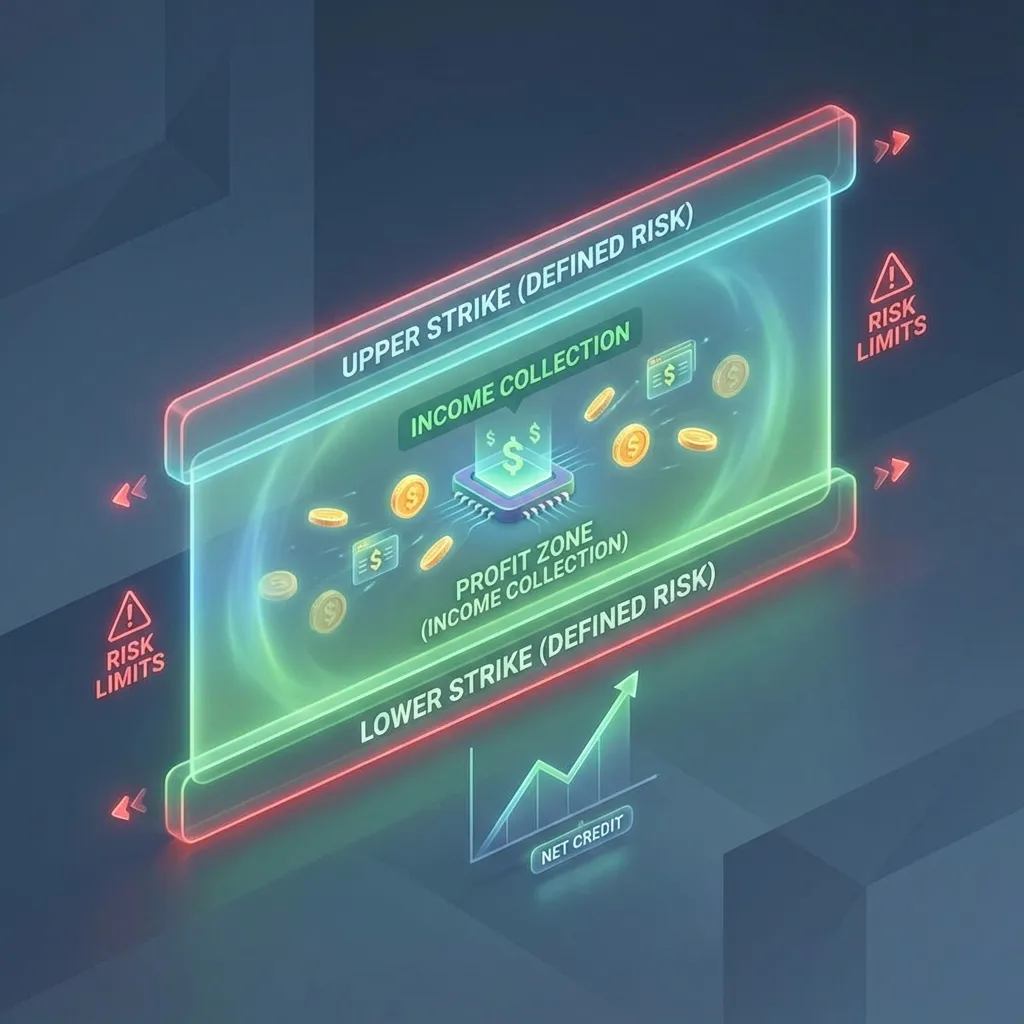

Make money when stocks do nothing. The iron condor strategy allows you to collect premium in range-bound markets with defined risk.

Buying options is expensive and risky. Credit spreads let you collect premium with defined risk—no unlimited losses. Learn bull put and bear call spreads for 65-70% win rates.