Roth IRA vs Traditional IRA: Which is Better?

Pay not a penny more in taxes than you have to. The choice between a Roth and Traditional IRA isn't just about "now vs. later"—it's a multi-million dollar decision that depends on your career trajectory, current tax laws, and retirement lifestyle. This comprehensive guide breaks down the math to help you keep more of your hard-earned wealth.

Key Takeaways

- Structure: Traditional IRA = Pre-tax (tax deduction now). Roth IRA = Post-tax (tax-free growth forever).

- The Pivot Point: If you expect your tax rate to be higher in retirement, choose Roth. If lower, choose Traditional.

- Flexibility: Roth IRAs allow penalty-free withdrawal of contributions (not earnings) at any time.

- RMDs: Traditional IRAs force withdrawals at age 73. Roth IRAs have no Required Minimum Distributions.

- High Income Strategy: Earn too much for a Roth? Use the Backdoor Roth strategy legally.

- Contribution Limits: $7,000 for 2025 ($8,000 if over 50). Limits apply to *total* IRA contributions.

Who This Is For

Intermediate LevelPerfect if you:

- You're just starting your career and are in a low tax bracket

- You're a high earner looking for tax deductions today

- You want to build a tax-free income stream for retirement

- You are planning your estate and legacy for beneficiaries

You'll learn:

- Detailed tax bracket math to optimize your choice

- The 5-Year Rule explaining when you can touch your earnings

- Strategies for high earners (Backdoor Roth & Mega Backdoor)

- How to hedge your bets with 'Tax Diversification' and fill buckets

- Impact of state taxes and ACA subsidies on your decision

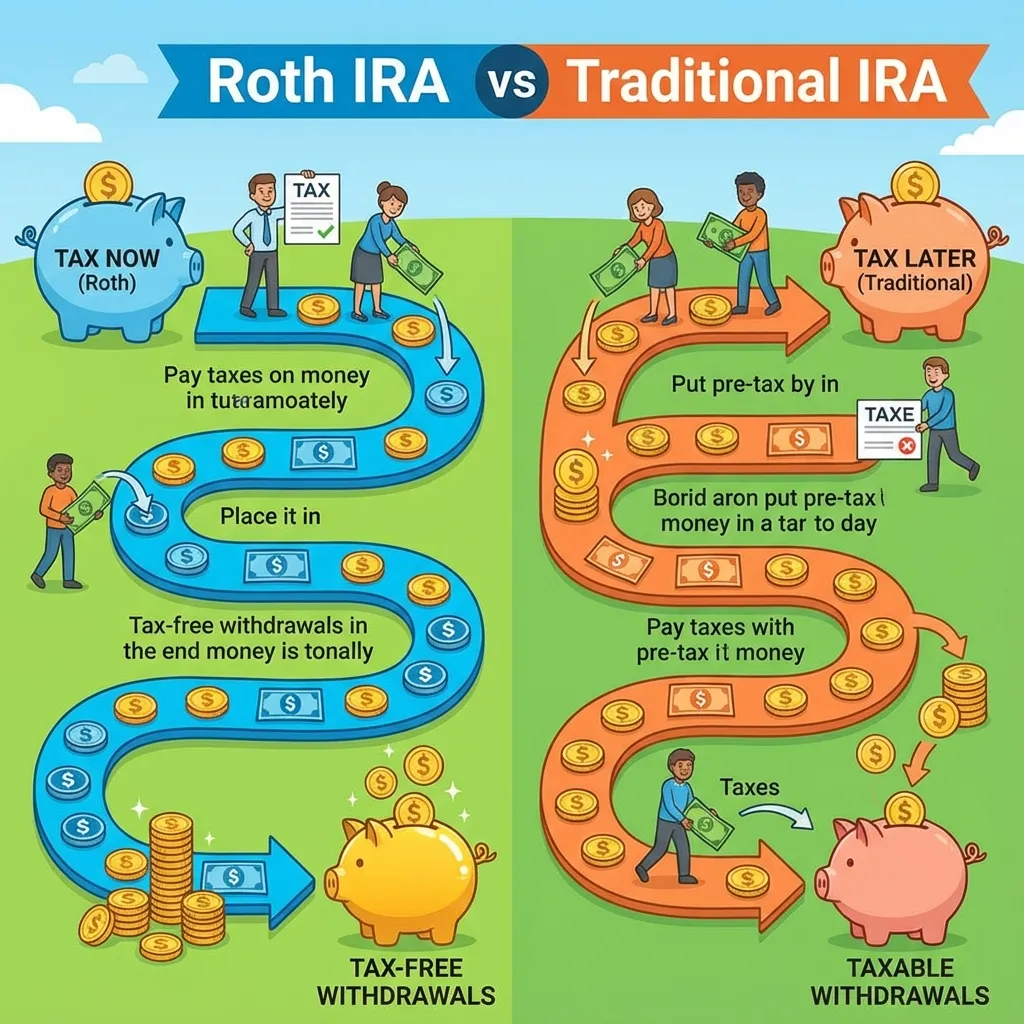

The Core Concept: Tax Now or Tax Later?

Individual Retirement Accounts (IRAs) are tax-advantaged investment accounts designed to help you save for retirement. While both types allow your money to grow tax-free while it is in the account, the major difference is when the IRS takes its cut.

This decision is fundamentally a wager on future tax rates. You are betting on whether strict mathematical optimization (paying the lowest rate possible) outweighs the psychological and logistical freedom of tax-free income in retirement.

Think of your retirement savings as a seed that grows into a harvest.

- Traditional IRA (Tax the Harvest)You don't pay taxes on the "seed" (contributions) today. You get a tax deduction now, which lowers your taxable income for the current year. However, you pay taxes on everything—the seed and the massive harvest (growth)—when you withdraw it in retirement. The IRS treats withdrawals as "Ordinary Income," taxed at your highest marginal rate at that time.

- Roth IRA (Tax the Seed)You pay taxes on the "seed" today (no deduction). You contribute effective "after-tax" dollars. But since you've already paid your dues, the entire harvest—every penny of growth over decades—is 100% tax-free in retirement. The IRS gets nothing when you withdraw.

Detailed Comparison Table

| Feature | Traditional IRA | Roth IRA |

|---|---|---|

| Tax Treatment | Pre-tax. Deductible now (income limits apply). reduces Adjusted Gross Income (AGI). | Post-tax. No deduction now. Does not lower AGI. |

| Growth | Tax-deferred. Use this to shield dividends and interest from annual taxes. | Tax-free. The most powerful compounding vehicle available. |

| Withdrawals | Taxed as ordinary income (Federal + State). | 100% Tax-free (if qualified: age 59½ + 5 years). |

| RMDs (Required Distributions) | Mandatory starting age 73. You must sell and pay taxes even if you don't need the money. | None. Money can grow forever and serve as a longevity hedge. |

| Access to Funds | Penalty (10%) + Tax if under 59½. Exceptions exist for first home ($10k) or education. | Contributions accessible anytime tax/penalty-free. Only earnings are locked. |

| Income Limits (2025) | None for contributing, but tax deduction phases out at higher incomes if you have a 401(k). | $150k (Single) / $236k (Married). High earners must use "Backdoor" method. |

The Math: Which One Wins?

The decision mathematically boils down to a comparison of your Marginal Tax Rate Today vs. your Effective Tax Rate in Retirement. This is often misunderstood.

The Formula

Assuming identical investment performance and fees:

- If Tax Rate Now > Tax Rate Retirement → Traditional Wins

- If Tax Rate Now < Tax Rate Retirement → Roth Wins

- If Tax Rate Now = Tax Rate Retirement → It's a Tie (Mathematically)

Why "It Depends" is the Honest Answer

Most people assume their tax rate will be lower in retirement because they will earn less income. This is often true, favoring the Traditional IRA. If you are in the 32% or 35% bracket now, taking the deduction is a guaranteed 32-35% return on your money immediately.

However, tax rates themselves might change. If Congress raises taxes across the board to fund deficits, your "low income" retirement bracket might still be taxed at a higher percentage than your current rate. The Roth IRA locks in your current tax rate, protecting you from future legislation.

Case Study: The Young Professional vs. The Peak Earner

Educational ExampleContrasting two different career stages

Scenario A: Sarah (Age 25, Junior Developer)

Sarah earns $55,000/year. She is in the 22% marginal tax bracket. She plans to invest $6,000 this year and let it grow for 40 years at 8% annual return.

Roth Choice

- • Cost: Pays 22% tax ($1,320) now.

- • Pot: $6,000 invested.

- • Growth: Grows to $130,346.

- • Exit: $0 tax due.

- • Result: $130,346 Spendable Cash.

Traditional Choice

If she invests $6,000 pre-tax, she saves $1,320 today. But that $1,320 is likely spent, not invested. In retirement, she might be in a higher bracket due to career success.

Winner: Roth IRA (Lock in low 22% rate now).

Scenario B: Michael (Age 45, Senior VP)

Michael earns $250,000/year. He is in the 35% marginal tax bracket (Federal + State). He plans to retire in Florida (0% state tax) with a modest lifestyle costing $80,000/year.

Traditional Choice

- • Action: Max out Traditional 401k/IRA.

- • Savings: Saves 35% immediately on every dollar.

- • Retirement: Withdraws $80k/year. Effective rate ~12%.

- • Arbitrage: Saved 35% entering, paid 12% exiting.

- • Gain: A massive 23% spread profit.

Roth Choice

Paying 35% tax now to avoid a 12% tax later is mathematically inefficient.

Winner: Traditional IRA (Tax Arbitrage).

This is a hypothetical scenario using historical market data for educational purposes only. Past performance does not guarantee future results.

Strategy: Tax Diversification & The "Three Buckets"

Sophisticated investors don't just pick one. They build "Tax Buckets" to give themselves control over their Adjusted Gross Income (AGI) in retirement. Controlling your AGI is a superpower—it determines your Medicare premiums, taxation of Social Security benefits, and eligibility for ACA subsidies.

1. Tax-Deferred

Traditional IRA / 401(k)

Fill this to lower current taxes. Withdrawal fills your low tax brackets in retirement.

2. Tax-Free

Roth IRA / HSA

Use this for big purchases (cars, trips) in retirement without spiking your tax bill.

3. Taxable

Brokerage Account

Taxed at favorable Capital Gains rates (0%, 15%, 20%). Offers total liquidity.

Example of Power: You need $100,000 for a renovation in retirement. If you pull it all from a Traditional IRA, it spikes your income, potentially pushing you into a higher tax bracket and doubling your Medicare premiums (IRMAA surcharges). Instead, you pull $40k from Traditional (staying in low bracket) and $60k from Roth (invisible to IRS). You got your $100k while keeping your official "income" low.

Limits & Eligibility (2025 Rules)

The IRS adjusts contribution limits annually for inflation. Here is what you need to know for the 2025 tax year.

Contribution Limits

- Under Age 50$7,000

- Age 50+ (Catch-up)$8,000

- *Limit applies to Total IRA contributions (Roth + Traditional combined). You cannot put $7k in each.

Income Limits (MAGI)

Eligible for Roth?

- Single Filers< $146,000 (Full)

- Phase-out$146k - $161k

- Married Filing Jointly< $230,000 (Full)

- Phase-out$230k - $240k

Advanced Strategy: The Backdoor Roth & Step-by-Step

"I earn too much to contribute to a Roth IRA. Am I locked out?"

No. You can use the "Backdoor Roth" strategy. High earners (doctors, lawyers, tech workers) use this to bypass the income limits legally.

The Backdoor Roth is a completely legal, two-step process sanctioned by the IRS (and confirmed by the Tax Cuts and Jobs Act). It effectively removes the income limit barrier.

- Open a Traditional IRA: Even though you can't take the tax *deduction* due to high income, you are allowed to *contribute*.

- Make a Non-Deductible Contribution: Deposit your $7,000. Do not invest it yet (keep it in cash/settlement fund) to avoid small gains.

- Wait for Settlement: Usually 1-3 business days.

- Convert to Roth IRA: Log into your brokerage and select "Convert to Roth IRA." Move the full $7,000 to your Roth account.

- Invest: Now you can buy your index funds or stocks within the Roth.

- File Form 8606: Come tax time, file IRS Form 8606. This form tracks your "basis" (the $7,000 you already paid taxes on) so you aren't taxed again on the conversion.

This strategy only works clearly if you have $0 balance in all other Pre-Tax IRAs (Traditional, SEP, SIMPLE). If you have an existing Rollover IRA with $93,000 and you add $7,000 to convert, the IRS views your total pot as $100,000. Since 93% is pre-tax, 93% of your conversion will be taxable.

The Fix: "Reverse Rollover" your existing IRA into your current employer's 401(k) before doing the Backdoor Roth. 401(k)s do not count towards the Pro-Rata rule.

Withdrawal Rules and Liquidity (The 5-Year Rule)

Liquidity is a major advantage of the Roth IRA. Unlike a 401(k) which is locked tight, the Roth functions as a backup emergency fund. Here is the hierarchy of withdrawals:

Exceptions to the Penalty

Even for earnings, the IRS allows penalty-free withdrawals for specific life events (taxes still apply on earnings in Traditional):

- First-time home purchase: Up to $10,000 lifetime limit.

- Qualified education expenses: College tuition for you or children.

- Birth or adoption: Up to $5,000 per parent.

- Health insurance premiums: If unemployed.

Legacy Planning: The "Stretch IRA" is Dead

For decades, the "Stretch IRA" allowed beneficiaries to inherit an IRA and stretch distributions over their lifetimes, allowing for massive tax-deferred growth. The SECURE Act changed this.

Now (The 10-Year Rule): Most non-spouse beneficiaries must empty an inherited IRA within 10 years.

- Inheriting a Traditional IRA: Your heirs pay income tax on every dollar they withdraw. If they are in their peak earning years, this inheritance could push them into a massive 35%+ tax bracket, losing 1/3 of your legacy to Uncle Sam.

- Inheriting a Roth IRA: Your heirs arguably get the best deal in the tax code. They can let the account grow tax-free for 10 full years, and then withdraw 100% of it tax-free in year 10. No RMDs during the 10 years, and no tax bill at the end. The Roth IRA is the superior estate planning vehicle.

FAQ: Common Questions

Can I have both a Roth and Traditional IRA?

What if I contribute to a Roth and then earn too much money?

Does a Roth IRA effect my financial aid for college (FAFSA)?

What about State Taxes?

The Best Time to Start is Now

Time is the most important factor in the Roth vs Traditional debate. The longer your money has to grow tax-free, the more powerful the Roth becomes. Don't get paralyzed by analysis.

Check your current tax bracket (marginal rate)

Open an account with Vanguard, Fidelity, or Schwab

Set up auto-invest into a Low-Cost Index Fund

Investment Risk Disclaimer

This content is for educational purposes only and should not be considered financial advice. All investments carry risk, including the potential loss of principal. Past performance does not guarantee future results. Before making any investment decisions, please consult with a qualified financial advisor who understands your personal financial situation, risk tolerance, and investment goals.

Stock Averager provides tools and educational content but does not provide personalized investment advice or recommendations.

About Stock Averager Team

Expert financial analysts dedicated to simplifying complex investment strategies for everyone. We build tools that help you make better money decisions.