Tax-Loss Harvesting: Turn Losses into Savings

Your stock dropped 20%. That's painful—but what if you could turn that loss into tax savings? The IRS effectively offers a "coupon" for your losses, subsidizing your risk if you know how to claim it. Tax-loss harvesting is the only guaranteed "alpha" in improved after-tax returns, allowing you to offset gains, reduce your tax bill by thousands, and immediately reinvest to catch the recovery.

Key Takeaways

- The Silver Lining: Tax-loss harvesting allows you to sell losing investments to offset capital gains dollar-for-dollar, lowering your overall tax bill.

- The $3,000 Deduction: If your losses exceed your gains, you can deduct up to $3,000 against your ordinary income (wages) annually. The rest carries forward forever.

- The Wash Sale Rule: You cannot buy the 'substantially identical' security within 30 days before or after the sale. Violating this permanently disallows the loss.

- Asset Location: This strategy ONLY works in taxable brokerage accounts. You cannot harvest losses in IRAs or 401(k)s because they are tax-sheltered.

- Tax Gain Harvesting: The lesser-known sibling strategy. If your income is low (0% capital gains bracket), you intentionally sell winners to reset your cost basis tax-free.

Who This Is For

Intermediate LevelPerfect if you:

- You have taxable investment accounts (non-retirement) with some positions in the red

- You realized big gains this year (e.g., sold a house or crypto) and want to offset the tax hit

- You are in a high tax bracket (24%+) where tax drags significantly on your net returns

- You want to optimize your portfolio's 'After-Tax Alpha' without changing your risk profile

You'll learn:

- How to swap ETFs (VTI -> ITOT) to harvest losses while staying 100% invested

- The difference between 'Spec ID' and 'FIFO' accounting methods (and why it matters)

- How 'Direct Indexing' allows billionaires to harvest losses even in a bull market

- The 'Tax Gain Harvesting' reverse strategy for low-income years

Part 1: What Is Tax-Loss Harvesting?

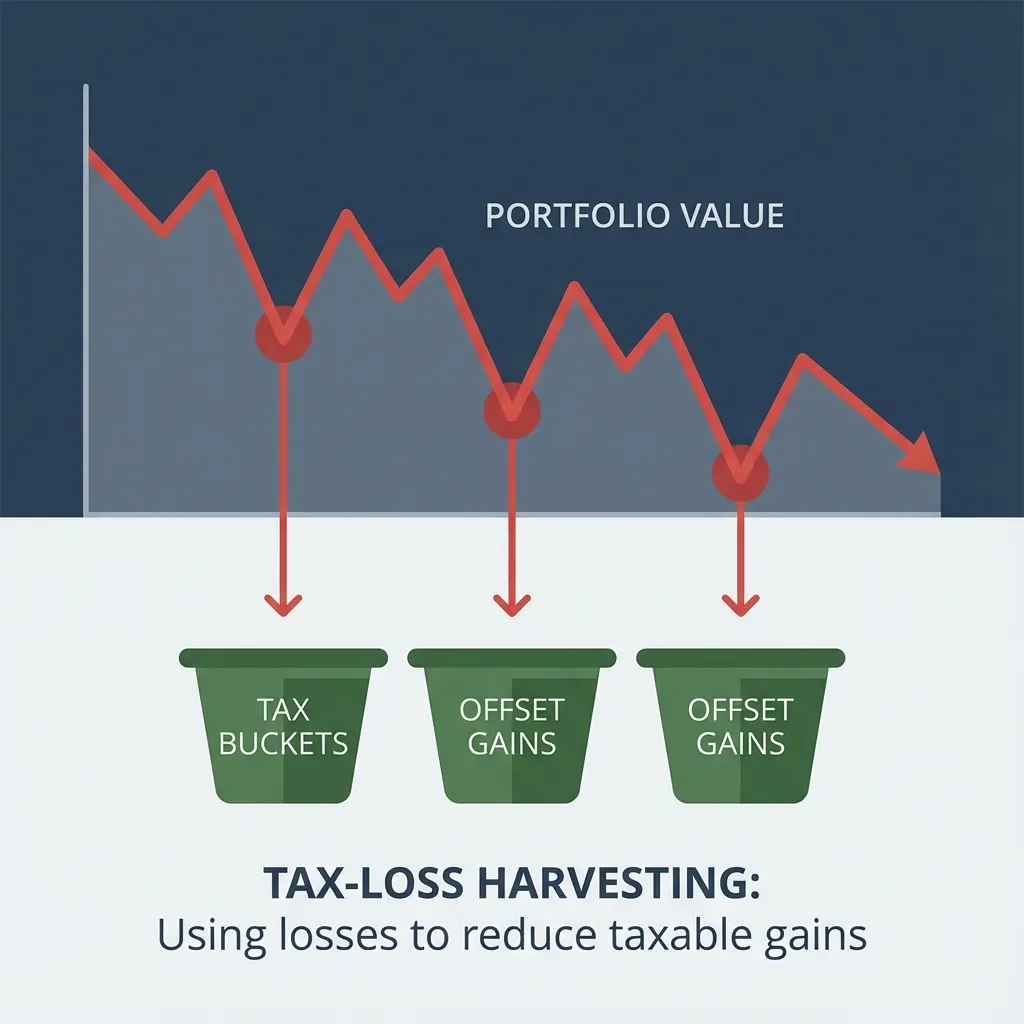

Tax-loss harvesting (TLH) is the proactive strategy of selling assets that have declined in value to "realize" a loss for tax purposes. You then immediately maximize the efficiency of that capital by reinvesting it in a similar (but not identical) asset.

It creates a "Tax Asset" (the realized loss) that you can use to neutralize "Tax Liabilities" (realized gains).

Think of it as turning lemons into lemonade. The market gave you a loss; the IRS gives you a tax deduction. If you just hold the losing stock, you have the "paper loss" but no tax benefit. You must sell to unlock the value.

The Math of the Deduction

Scenario: You earn $150,000/year (24% bracket). You sold Nvidia for a $10,000 profit.

Without Harvesting: You owe $1,500 - $2,000 in Capital Gains taxes.

With Harvesting: You sell your losing PayPal position for a $10,000 loss.

Net Result: $10,000 Gain - $10,000 Loss = $0 Net Gain.

Tax Bill: $0. You just saved ~$2,000 cash.

Part 2: The Hierarchy of Offsets

The IRS has a specific order in which losses are applied. It’s not just a free-for-all. Understanding this hierarchy helps you plan which lots to sell.

1. Short-Term vs. Short-Term

Short-term losses (held < 1 year) first offset short-term gains (taxed at regular income rates, up to 37%). This is the most valuable offset because short-term tax rates are highest.

2. Long-Term vs. Long-Term

Long-term losses (held > 1 year) offset long-term gains (taxed at 0%, 15%, or 20%).

3. The Crossover

If you have excess short-term losses, they can then offset long-term gains. Conversely, excess long-term losses can offset short-term gains.

4. Ordinary Income (The Bonus)

If you still have net losses after offsetting ALL gains, you can deduct up to $3,000 against your salary/wages.

Example: You have a net loss of $20,000. You deduct $3,000 this year. You carry forward $17,000 to next year. This carry-forward is indefinite (until you die).

Part 3: The Wash Sale Rule (The Trap)

The IRS is smart. They don't want you to sell a stock to claim a loss and then immediately buy it back 5 minutes later just to game the system.

⚠️ Critical Rule

If you sell a security at a loss and buy a "substantially identical" security within 30 days before OR after the sale, the loss is disallowed. It is added to the cost basis of the new position.

How to Sidestep It (The ETF Swap)

The phrase "substantially identical" is key.

• Identical: Selling VOO (Vanguard S&P 500) and buying SPY (State Street S&P 500). They track the exact same index. Risky.

• Similar, not Identical: Selling VOO (S&P 500) and buying VTI (Total US Market). The indices are different (500 stocks vs 4000 stocks), but the return correlation is 99%.

| Sell This (Loser) | Buy This (Replacement) | Safety Verdict |

|---|---|---|

| VTI (Total Stock Mkt) | SCHB (Schwab Broad Mkt) | Safe (Different Indices) |

| VOO (S&P 500) | VV (Large Cap) | Safe (Different methodology) |

| QQQ (Nasdaq 100) | VGT (Tech Sector) | Safeish (Correlated but distinct) |

| TSLA (Tesla) | TSLA Call Options | WASH SALE (Options count!) |

Real Example: The 'Tech Crash' Correction

Educational ExampleHarvesting $15,000 in losses while staying invested

It's October. The Nasdaq drops 15%. Your QQQ position is down $15,000.

Step 1: The Sale

Sell $100,000 of QQQ. Proceed: $85,000. Realized Loss: $15,000.

Step 2: The Swap

Immediately use the $85,000 to buy VGT (Vanguard Tech ETF). You are still invested in Tech.

Step 3: The Recovery

In November, Tech rallies 10%. Your VGT position goes up. You participated in the rally just like you would have with QQQ.

Step 4: The Switch Back

On Day 31 (after the Wash Sale window), you can sell VGT and buy back QQQ if you prefer the original ETF. Or just keep VGT.

This is a hypothetical scenario using historical market data for educational purposes only. Past performance does not guarantee future results.

Part 4: Accounting Methods (Spec ID vs FIFO)

This is an advanced detail that saves you thousands. By default, most brokers (Robinhood, Vanguard, Fidelity) use "FIFO" (First In, First Out). This means when you click "Sell," they sell the oldest shares first.

Why FIFO is bad for harvesting: In a bull market, your oldest shares are likely your biggest winners (lowest cost basis). Selling them produces the Highest Tax Bill.

You want "Spec ID" (Specific Identification): This allows you to cherry-pick exactly which shares to sell. You explicitly tell the broker, "Sell the 10 shares I bought last week at $200" (which are at a loss), not the ones you bought 5 years ago at $50.

- Vanguard: Search "Cost Basis Method" → Change to "Spec ID".

- Fidelity: Account Features → Cost Basis Information → Change to "Actual Cost".

- Robinhood: Often defaults to FIFO. Check help center for "Specific Lot Identification."

Part 5: Direct Indexing (The Billionaire Strategy)

Wealthy investors don't buy SPY ETF. They use "Direct Indexing."

Direct Indexing means buying all 500 stocks in the S&P 500 individually. Why would anyone do this nightmare administrative task? Deconstruction.

In any given year, the S&P 500 might be UP +10%. But inside that index, 150 companies might be DOWN -20%.

- If you own SPY ETF: You have a paper gain. You cannot harvest any losses.

- If you own Direct Index: You can sell those 150 losing stocks individually. You harvest massive losses to offset gains elsewhere, while still holding the 350 winning stocks.

Previously, you needed $10M+ AUM for this. Now, "Robo-Advisors" like Wealthfront (minimum $100k) and Betterment offer automated Direct Indexing. They use software to micro-harvest daily. It essentially squeezes tax efficiency out of a stone.

Part 6: Tax Gain Harvesting (The Reverse Uno Card)

Everyone talks about harvesting losses. But sometimes, you should harvest GAINS.

When your taxable income is low enough to fall into the 0% Capital Gains Bracket.

For 2024/2025, if your taxable income is under ~$45,000 (Single) or ~$90,000 (Married), your long-term capital gains tax rate is ZERO.

The Strategy:

1. You have a stock (AAPL) with a $10,000 gain.

2. You are in the 0% bracket this year (student, sabbatical, early retirement).

3. You SELL the stock. You realize the $10,000 gain.

4. You pay $0 taxes (thanks to the 0% bracket).

5. You immediately BUY IT BACK. (Wash Sale rule does NOT apply to gains).

The Result: You just "Stepped Up" your cost basis for free. If you sell AAPL in 10 years when you are in a high tax bracket, your tax will be calculated from this higher price, saving you huge money later.

Part 7: State Tax Considerations

Most states follow federal rules for capital gains, but not all.

- California / New York / New Jersey: High-tax states treat capital gains as ordinary income. There is no lower "capital gains rate." This makes execution even more critical. Harvesting losses here saves you Federal Tax (15-20%) AND State Tax (up to 13%), totaling 33%+ instant ROI.

- The "Carry Forward" Trap: Some states restrict how much loss you can carry forward differently than the Feds. Always check with a local CPA if you have massive losses ($100k+).

FAQ: Tax Loss Harvesting

When is the best time to harvest?

Can I harvest crypto losses?

What about dividends?

Does this reset my holding period?

Don't Leave Money on the Table

Investment returns are uncertain. Tax savings are guaranteed. Control what you can control.

Check for losses > $1,000.

Switch accounting to Spec ID.

Harvest, Swap, and Save.

Investment Risk Disclaimer

This content is for educational purposes only and should not be considered financial advice. All investments carry risk, including the potential loss of principal. Past performance does not guarantee future results. Before making any investment decisions, please consult with a qualified financial advisor who understands your personal financial situation, risk tolerance, and investment goals.

Stock Averager provides tools and educational content but does not provide personalized investment advice or recommendations.

About Stock Averager Team

Expert financial analysts dedicated to simplifying complex investment strategies for everyone. We build tools that help you make better money decisions.