DCA Out: How to Sell Without Timing the Market

Buying is easy; selling is hard. Learn how to use Dollar Cost Averaging in reverse to take profits or generate retirement income smoothly.

Build long-term wealth with proven investment strategies and frameworks.

Buying is easy; selling is hard. Learn how to use Dollar Cost Averaging in reverse to take profits or generate retirement income smoothly.

Different sectors win at different times. Learn how to rotate your portfolio into the right industries based on the business cycle.

Is your portfolio too US-centric? Discover why you need global exposure to reduce risk and capture growth in emerging economies.

Don't buy at the top. The RSI indicator warns you when a stock is overheated or oversold, helping you time your entries and exits better.

Cut through the noise. Moving averages help you identify the true trend, spot reversals, and find dynamic support levels used by pros.

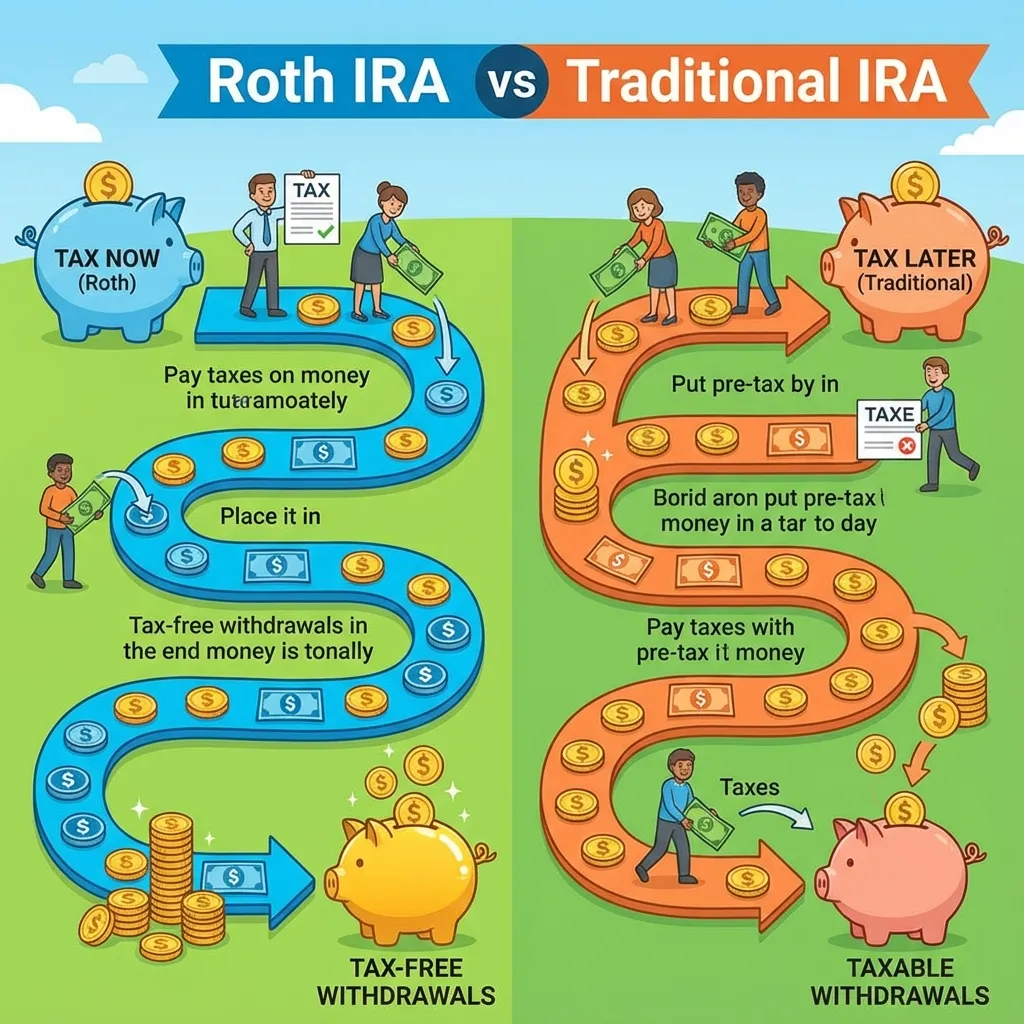

Tax now or tax later? Choosing the right IRA can mean thousands more in retirement. We break down the math to help you decide.

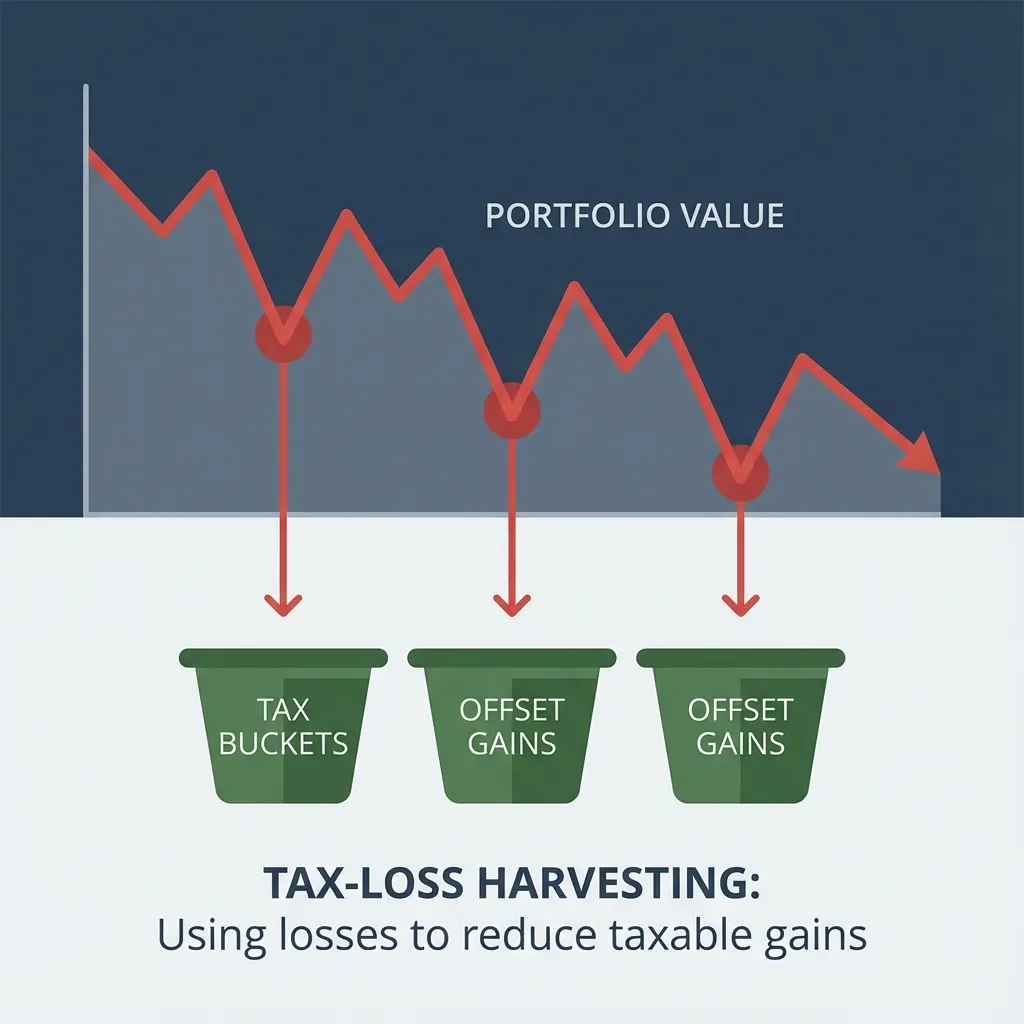

Don't let market drops go to waste. Learn how to harvest losses to offset gains and reduce your tax bill, boosting your after-tax returns.

Don't put all eggs in one basket. Diversification reduces risk without sacrificing returns. Learn how to diversify across stocks, sectors, and geographies.

₹10 lakh to invest. How much per stock? Position sizing determines whether you survive crashes or get wiped out. Master this underrated skill.

95% of fund managers underperform the index over 15 years. If professionals can't beat it, can you? Here's the honest truth about stock picking vs index funds.

Stock drops from ₹100 to ₹70 while you hope for recovery. Stop-loss would have sold at ₹95, limiting loss to 5% instead of 30%. Essential for every trader.

Imagine getting paid every quarter just for owning stocks. Dividend investing turns your portfolio into a cash-generating machine—passive income that grows year after year.