Options Trading

Iron Condor: Profit from Sideways Markets

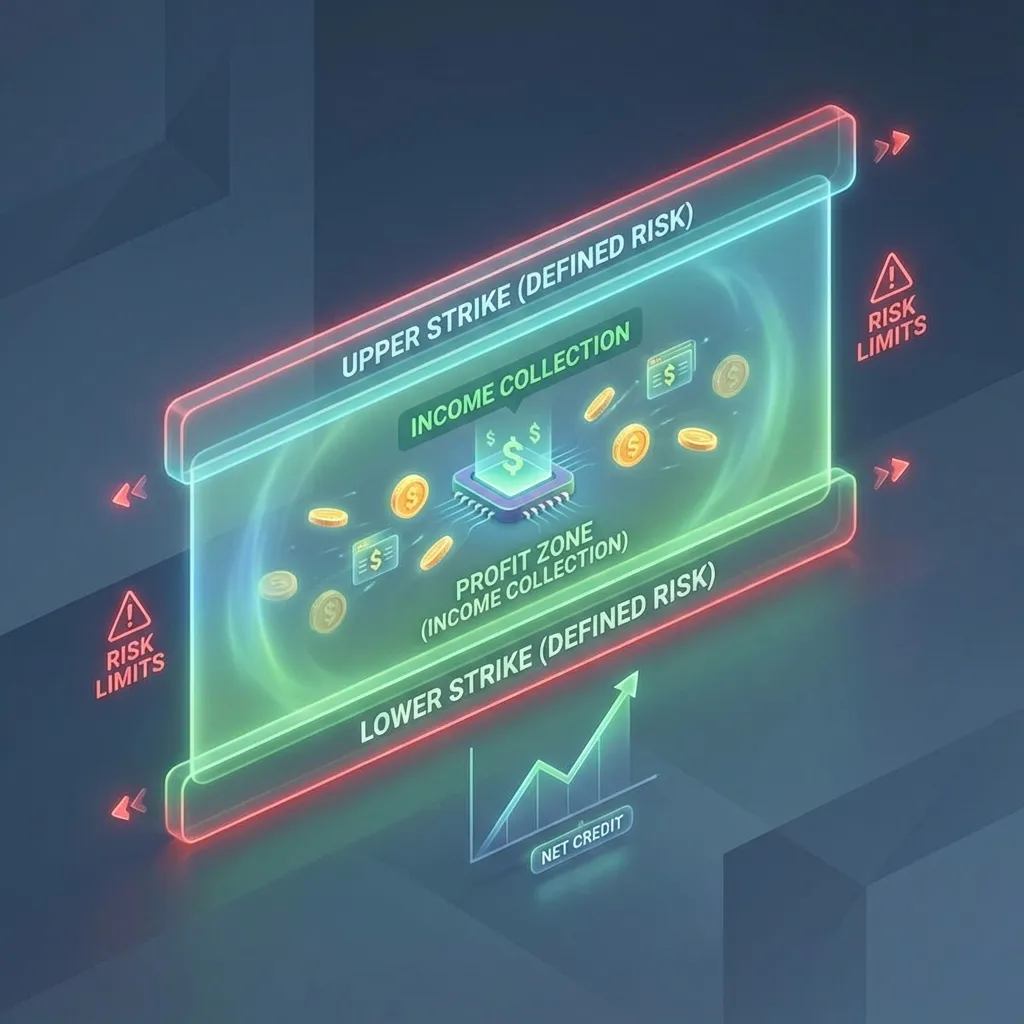

Make money when stocks do nothing. The iron condor strategy allows you to collect premium in range-bound markets with defined risk.

January 10, 2026

10m

SA

Stock Averager TeamExpert insights on investment strategies, options trading, and financial planning

Make money when stocks do nothing. The iron condor strategy allows you to collect premium in range-bound markets with defined risk.

Buying options is expensive and risky. Credit spreads let you collect premium with defined risk—no unlimited losses. Learn bull put and bear call spreads for 65-70% win rates.

Want to buy a stock at $95 but it's at $100? Sell a $95 put, collect $3 premium, and either keep the premium or buy at $92 effective cost. Win-win.

Own 100 shares? Sell covered calls and collect 1-3% monthly premiums. It's the safest options strategy—you can't lose more than if you just held the stock.