International Diversification: Beyond the US Market

Is your portfolio too US-centric? Discover why you need global exposure to reduce risk and capture growth in emerging economies.

Expert insights on investment strategies, options trading, and financial planning

Is your portfolio too US-centric? Discover why you need global exposure to reduce risk and capture growth in emerging economies.

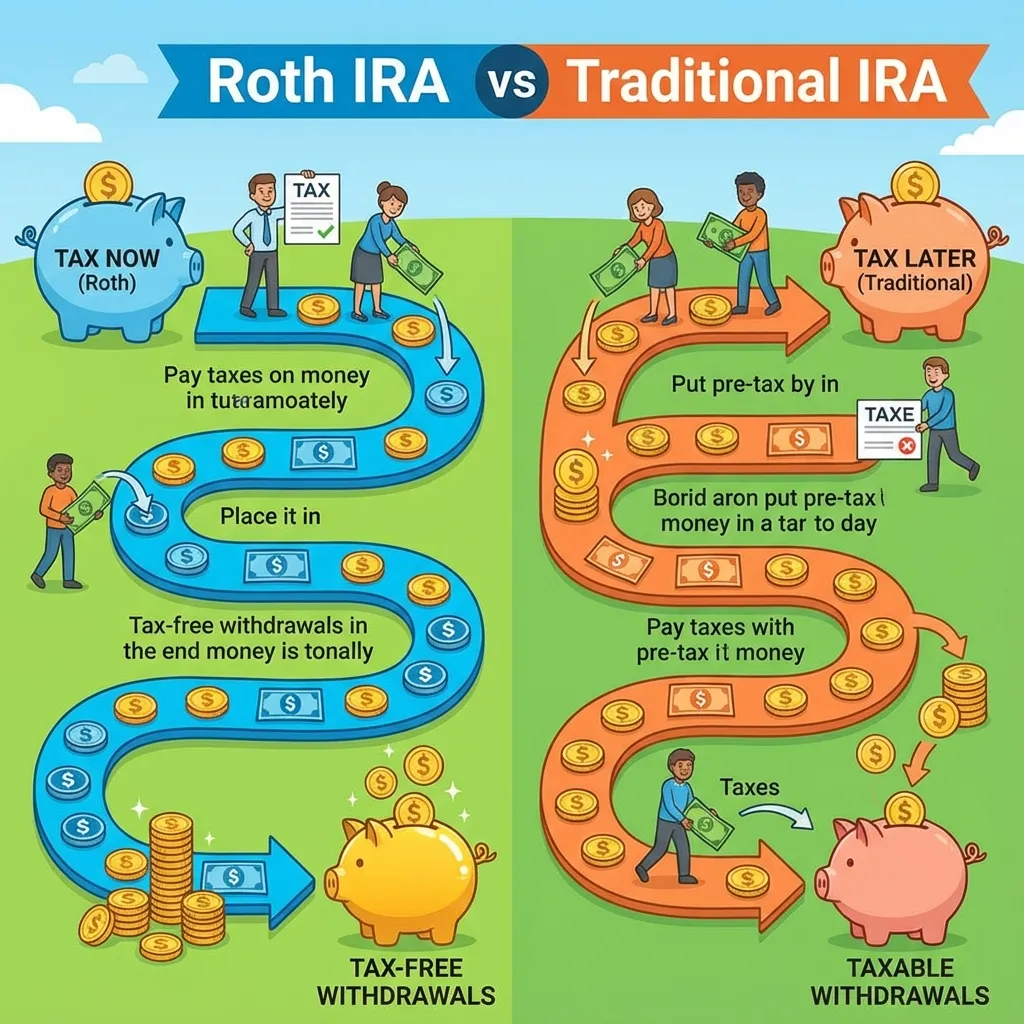

Tax now or tax later? Choosing the right IRA can mean thousands more in retirement. We break down the math to help you decide.

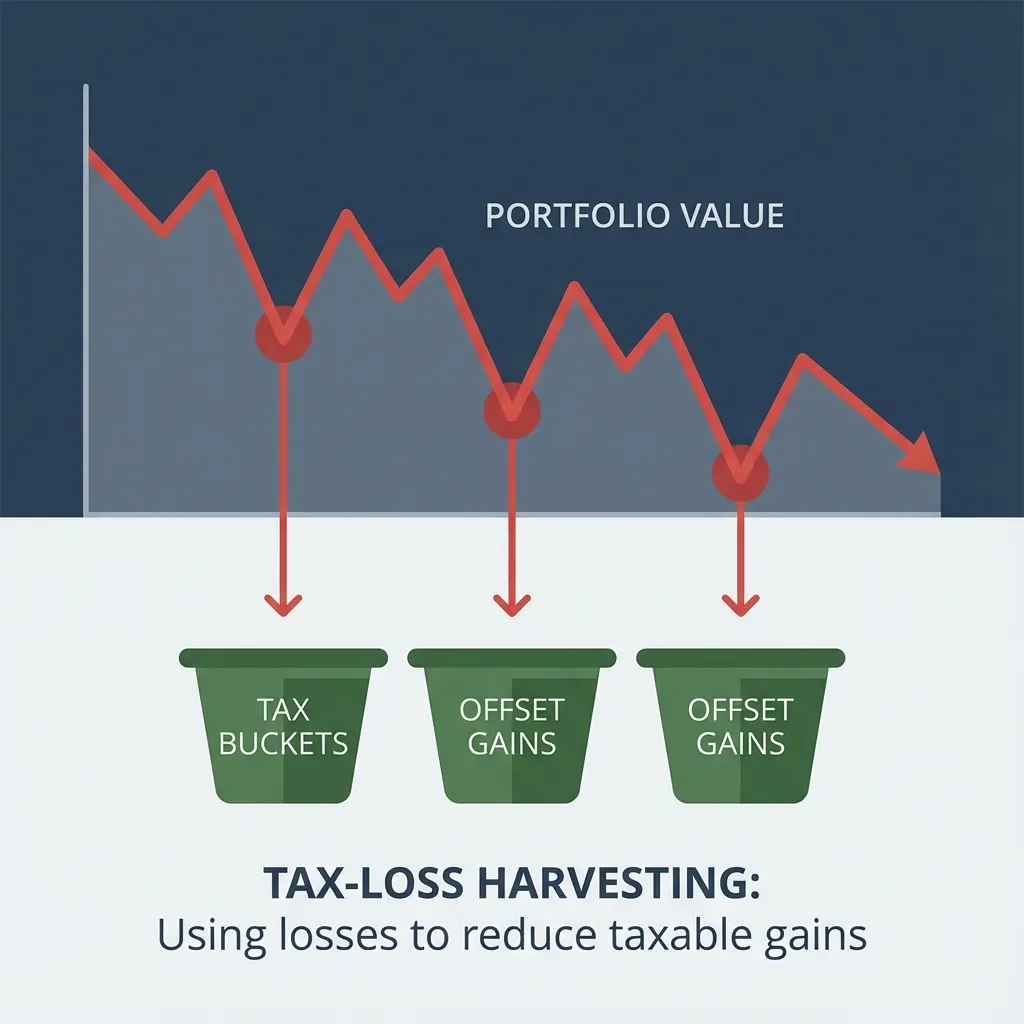

Don't let market drops go to waste. Learn how to harvest losses to offset gains and reduce your tax bill, boosting your after-tax returns.

Don't put all eggs in one basket. Diversification reduces risk without sacrificing returns. Learn how to diversify across stocks, sectors, and geographies.

95% of fund managers underperform the index over 15 years. If professionals can't beat it, can you? Here's the honest truth about stock picking vs index funds.

Stock A trades at ₹1,000. Stock B at ₹100. Which is cheaper? Price means nothing—P/E ratio tells you if you're overpaying. Learn the most important valuation metric.

Stop overthinking. Build a bulletproof DCA portfolio in 5 steps: 70% index funds, 20% international, 10% individual stocks. Set it, forget it, get rich slowly.

Got ₹10 lakh to invest? Lump sum wins 68% of the time historically, but DCA wins psychologically. Here's the data-driven approach to decide.

RCA is India's version of DCA—invest ₹5,000/month in Nifty 50 and watch volatility become your friend. Perfect for SIPs, stocks, and mutual funds.

What if there's a smarter way than DCA? Value Averaging forces you to buy more when prices drop and less when they rise—automatically. See if it's right for you.

Windfall or paycheck? Deciding between a Systematic Investment Plan (SIP) and a Lump Sum investment is easier than you think. Here's the math behind the choice.

Stop sitting on the sidelines. Learn how the stock market works, how to buy your first stock, and why index funds are perfect for beginners. Step-by-step guide with real examples.