Portfolio Rebalancing: The Art of Selling Winners

It feels wrong to sell your best performers, but it's essential for risk control. Learn the when, why, and how of portfolio rebalancing.

Expert insights on investment strategies, options trading, and financial planning

It feels wrong to sell your best performers, but it's essential for risk control. Learn the when, why, and how of portfolio rebalancing.

Different sectors win at different times. Learn how to rotate your portfolio into the right industries based on the business cycle.

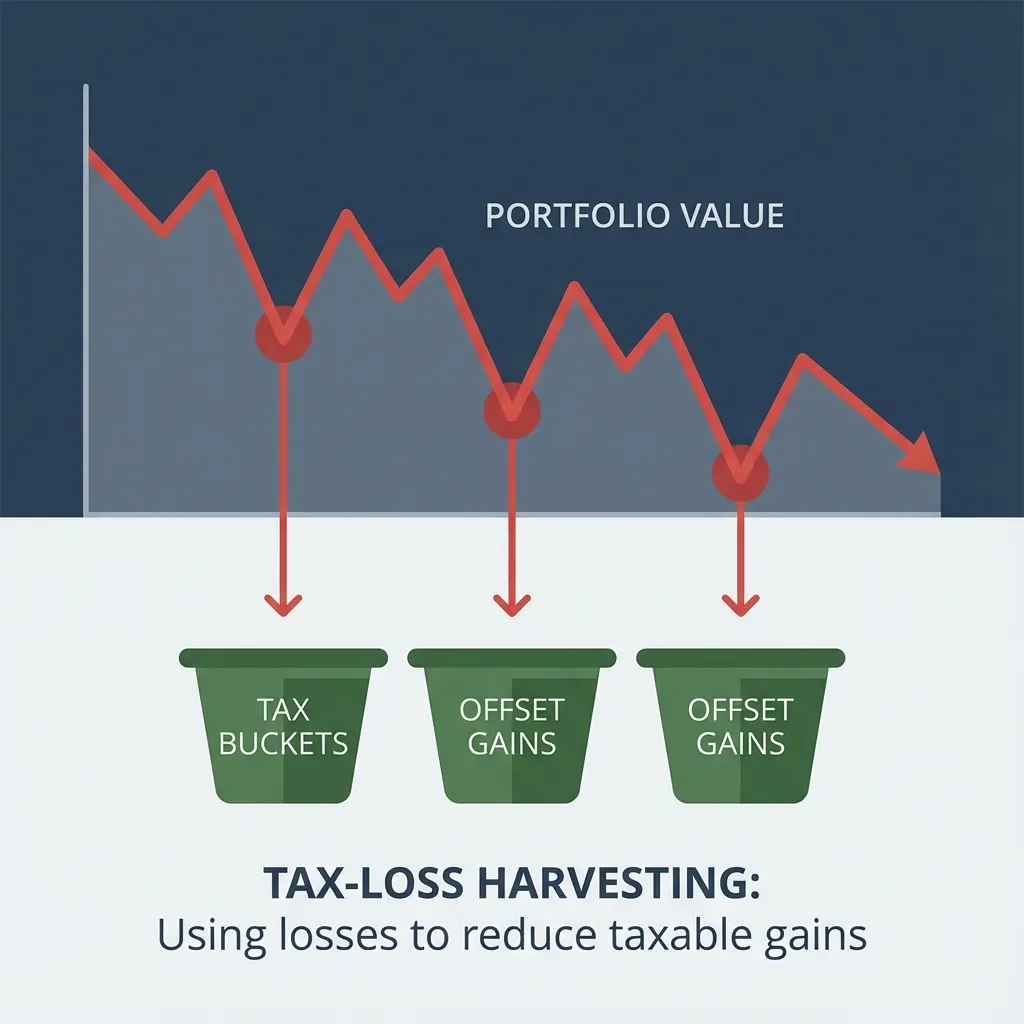

Don't let market drops go to waste. Learn how to harvest losses to offset gains and reduce your tax bill, boosting your after-tax returns.

Want to buy a stock at $95 but it's at $100? Sell a $95 put, collect $3 premium, and either keep the premium or buy at $92 effective cost. Win-win.

Own 100 shares? Sell covered calls and collect 1-3% monthly premiums. It's the safest options strategy—you can't lose more than if you just held the stock.

Got ₹10 lakh to invest? Lump sum wins 68% of the time historically, but DCA wins psychologically. Here's the data-driven approach to decide.

What if there's a smarter way than DCA? Value Averaging forces you to buy more when prices drop and less when they rise—automatically. See if it's right for you.

Windfall or paycheck? Deciding between a Systematic Investment Plan (SIP) and a Lump Sum investment is easier than you think. Here's the math behind the choice.

Stop worrying about market crashes. Discover how Dollar Cost Averaging (DCA) helps you turn volatility into an advantage and build long-term wealth on autopilot.